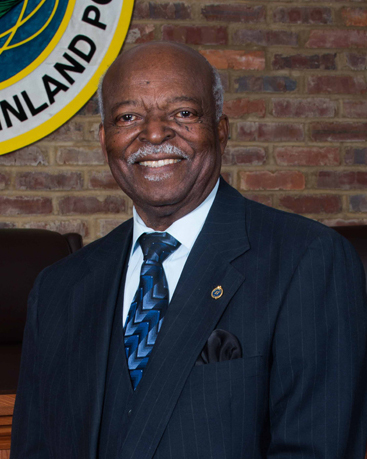

If the Bainbridge City Council approves a proposed two-mill increase to the city’s millage rate, the resulting property tax collections will generate an additional $700,000 per year toward city revenue, according to Mayor Edward Reynolds.

The Bainbridge City Council will hold public hearings on the proposed millage increase before taking a final vote.

Reached by telephone Monday evening, July 21, Mayor Reynolds said he and the Bainbridge City Council discussed city’s financial status at annual retreat.

Below is a paraphrasing of some of the mayor’s comments.

Significantly lower sales tax since 2008 have hurt city’s budget

“The city’s major sources of revenue are property tax and sales tax. We had big drop in sales tax starting in 2008. Property values nationwide took a huge drop in 2008. There was a small uptick in property values last year. That’s why we had to advertise we were increasing the millage last year even though we weren’t increasing the millage rate, we just collected a little more money because of the change in the total value of properties in the digest had risen.”

“We’ve done what we can in the past six years to weather the economic storm. We’ve continued to have to draw upon our reserve balance of unrestricted funds. That’s been drawn down to about $1.5 million. The reserves are not necessarily cash, but reflects the amount that has not been obligated to fund any project or debt, or isn’t money that’s part of an enterprise fund like the water and sewer fund.”

“The lowering of our reserves has made us a little nervous because auditors have told us we need to have a certain percent of our annual budget in reserves. Although we’re not in an unhealthy fiscal situation right now, we don’t want to enter one. We’ve continued on for several years in the hopes that things would improve, but they haven’t.”

Previously, auditors have told city officials that they need to have an amount in reserves equal to about three months of operating expenses to run the city government.

The mayor said costs related to employee benefits, including health care, have continued to rise during the economic downturn. He said employee benefits were causing the largest impact on the city’s budget at present.

“We feel we’re still lower millage to municipalities and local governments in the area.”

“With the next fiscal year’s budget, we hope to get back into a positive cash flow situation to begin putting money back into reserves.”

Impact of flat revenue on city operations

“We’re certainly not doing some of the projects we’d like to because of budget issues.”

“For example, projects like the Riverwalk and street maintenance issues. We have such a tight budget that we have to pick and choose what we’re going to work on. That’s a situation we’ve got to move past because we’ve got to be able to maintain our infrastructure. When people see us moving slow in a particular area, well, it’s true. But we’re moving slow because of budgetary constraints.”

“City Hall was a long-term capital project that was funded out of a separate ‘pot’ of money and we have some limits as far as keeping those pots separate.”

“Water and sewer rates are also going to go up a little bit, but that money stays in a separate fund. The rates are rising partly because of inflation, and also because we need to build back up that enterprise fund because of infrastructure costs and expansion.”

The mayor said the money spent to construct the city’s garbage transfer station on Avenue C, as well as contingencies that have had to be paid for to get it up and running, do not factor into the decision to raise the city’s millage.

“We feel like long-term, what we’re investing in the solid waste transfer station will pay for itself because it’s saving money. Some of the money used on that project is from SPLOST dollars.”

Council aiming to keep operating city as a business

“If you look at the makeup of our council, they’re fiscally responsible, local business people. Although this has been a tough decision, it was the right decision. There’s certain infrastructure and quality of life improvements, how our town appears to people while they’re here, are important to looking like you’re a viable place to do business.”

“Anyone who runs a business understands that you have to reinvest in that business. In a normal situation, you reinvest using profits. We just have reserves, but we’re spending so much on our payroll and payroll-related expenses, such as health care, the cost of that has gone crazy.”

“I think people understand, if you don’t have some of those improvements being made on your maintenance-related items, you can get in a hole real quick of not being able to afford to get out of that.”

Be the first to comment